Governance

Development of the Governance Framework

and Structures

What were the principles used to design the governance structures?

The Solidarity Fund was deeply committed to ensuring it protected and used the generous donations it received in the most effective and impactful way possible. The Fund was established to be completely independent while working closely with government, the private sector and civil society to implement its programmes. It was committed to robust governance and transparency to ensure the resources the Fund was entrusted with, were leveraged in the best way possible to alleviate the effects of the pandemic on all South Africans.

The Fund was governed by an independent and highly respected Board of Directors and led by an experienced and skilled Executive Management Team (Exco), with the CEO at the helm. The Board constituted sub-committees to strengthen governance and added appropriate additional capacity where that was required. Furthermore, some of the partners at operational level also brought an additional layer of governance by questioning and examining everything, together with internal and external audits that also strengthened the control environment of the Fund.

Board members selection process

Credible individuals were identified who possessed the necessary skills set to run a Fund with strong governance and transparency. It was important to ensure that the Board represented all social partnerships (government, business, and civil society).

The focus was on trying to formulate a group of people who would hold a high standard of governance but who could also represent many different South Africans and who brought with them relationships with funders and donors.

Thereafter the Fund needed to identify and appoint a Chief Executive Officer (CEO). The decision considered whether the candidate would be fit for purpose and whether they had the time to serve as CEO. An interim CEO who served for approximately six months was appointed, with a permanent CEO appointed thereafter on an annual contract.

Brief description of roles and responsibilities

The Board and the Exco were committed to ensuring that the Fund operated with agility, integrity, and transparency. This included ensuring that all donations were screened, recognised, accounted for, and effectively managed; those disbursements were aligned with the Fund’s mandate; and that impact was measured and reported. The Fund’s governance framework articulated the comprehensive set of decision-making, approval, and oversight arrangements the Fund employed to discharge its mandate. The Board, chaired by Gloria Serobe, assisted by Adrian Enthoven as her Deputy Chairman, provided guidance and oversight over all other bodies within the Solidarity Fund, namely:

- The Audit and Risk Committee

- The Fundraising Committee

- The Disbursements Committee

- The Executive Committee

How the various committees functioned

A structure called the War Room comprising the Chairman, Deputy Chairman, Adviser and Exco met daily to enable quick decision making. As the intensity of strategic decisions on programmes required reduced, the frequency of these meetings also reduced (after 18 to 24 months).

The Board initially met weekly to adjudicate on the strategic direction, receive updates, assess risks and approve programmes with allocations of greater than R100million.

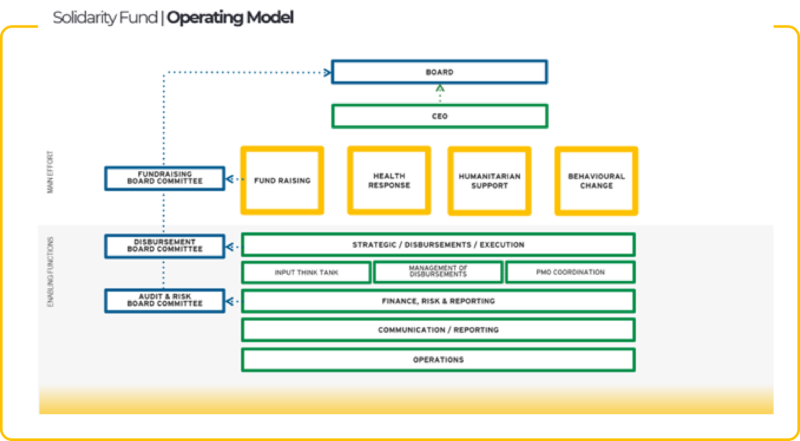

The relationship of each Board subcommittee is described relative to the primary functions of the Solidarity Fund in the figure below:

Brief description of roles and responsibilities

The Fundraising Committee, under the guidance of the chair, provided oversight of the Solidarity Fund’s fundraising function.

The categories of donors around which fundraising took place included large corporates, large foundations, high net worth individuals, smaller corporates and foundations, and individual citizens. The fundraising team pursued a different approach for each category of donor, with a separate team driving the activity in each category.

1. Responsibilities

1

The Fundraising Committee was responsible for overseeing the fundraising function within the Solidarity Fund.

2

The Committee members guided and supported the fundraising team in maximising the capital raised for the Solidarity Fund, overseeing the fundraising strategy, the choice of fundraising team leaders and channels through which fundraising activities were pursued.

3

The Committee ensured that there was transparency on where and how the Solidarity Fund raised capital and ensured that there was appropriate risk management over the source of the funds donated to the Fund.

4

The Committee guided the Solidarity Fund to ensure that all citizens, corporations or foundations that wished to contribute to it were able to do so, and that all contributions were recognised and celebrated.

5

The Fundraising Committee had oversight over the process of reconciliation of funds committed.

2. People

In the initial phase, the following people were invited to attend the Committee’s meetings: The Chief Executive Officer (CEO), Chief Financial Officer (CFO), Head of Operations, legal advisor, internal auditors, Executive Lead: Fundraising and Company Secretary. Over time the legal advisors and internal auditors did not attend these meetings, and the donor management team was added to the list of invitees.

Professional advisors, officers, or members could be invited at the discretion of the Chairman if inputs from them were required.

Brief description of roles and responsibilities

The Disbursements Committee, under the guidance its chairman, provided oversight of the disbursement and deployment of the Solidarity Fund’s resources to support the country to address the impact of COVID–19 in South Africa.

The Disbursement Committee had an independent role with accountability to the board and was comprised of at least 3 members, all of whom were required to be independent.

The committee met twice a week to assess cover notes and proposals provided by the Pillar Heads. Proposals that were submitted to the Disbursements Committee had already been vetted by a technical advisory panel and recommended by War Room and/or the Executive Disbursements Committee. The Disbursement Committee’s role was to do a final feasibility assessment before approving projects for implementation. If the value of the project was larger than R100m the Committee would recommend the proposal for approval by the Board.

The Disbursement Committee developed and oversaw the strategy that defined how the Solidarity Fund would apply its capital to ensure the greatest impact, supporting significant and transformational programmes.

Within the guidelines of the disbursement strategy, the Committee identified problems or challenges where the Solidarity Fund could make an impact and identified potential programmes that could help mitigate those challenges.

Each programme was evaluated by a technical team to ensure the solution was appropriate, and an effective use of the Fund’s resources.

The programmes were proposed to an executive disbursements team which overtime was collapsed into War Room that then proposed the programme ideas to the Board Disbursement Committee.

Approved programmes were implemented by the Fund through an ecosystem of partner organisations that brought their unique capabilities to the execution, evaluation, and monitoring of each programme.

1. Responsibilities

1

The Disbursement Committee provided oversight over the Solidarity Fund’s disbursement processes, teams, and programmes.

2

The Committee approved the disbursement strategy for the Fund, ensuring the strategy aligned with the overall mandate and purpose of the Solidarity Fund.

3

The Committee considered whether the programmes presented to it were appropriately attributed and packaged, value for money, and would achieve the goals laid out in the programme proposal, while ensuring each programme was aligned to the mandate of the appropriate focus area, and the Fund as a whole.

4

The Committee provided oversight over the Fund’s disbursement governance processes ensuring decisions were made effectively, ethically, and within the boundaries of the Solidarity Fund’s mandate.

5

The Committee was accountable for ensuring that the development of disbursement programmes, the selection of implementation partners, and any associated procurement met the Fund’s high standards of governance and transparency.

6

The Committee was responsible for ensuring the tracking of disbursed funds and the measurement of the impact in line with the Fund’s mandate.

7

The Committee measured and tracked the level of spend and the ancillary downstream economic impact.

2. People

Any Board member who was not a member of the Committee was entitled to attend the meetings but did not have voting rights.

Professional advisors, officers or members of staff whose input may have been required, were able to be in attendance to meetings, at the discretion of the Chairman. The Chairman had the authority to invite any person he/she deemed appropriate to attend any of the meetings that took place.

Decisions could be taken via round robin resolutions between meetings – which whilst an effective method to ensure no decisions were delayed was not preferred by the Committee as it often does not generate the right kind of rigour of engagement. Given the high frequency of meetings this methodology was not utilised often.

Brief description of roles and responsibilities

The primary objective of the ARC was to assist the Board in discharging its responsibilities related to safeguarding of assets, ensuring adequate and effective systems and control processes, preparation of financial statements in compliance with the legal and regulatory requirements and accounting standards, and the oversight of external audit appointments and functions. The Committee, by election of the Fund, became a statutory committee and as such held an independent role with accountability to the Board.

1. Responsibilities

1

Oversee risk areas, accounting policies and internal controls

2

Monitor management accounts, ensuring adequate financial records are maintained

3

Engage with internal and external auditors’ reports

4

Nominate, for appointment by the Board, an independent registered auditor.

5

Determine the fees to be paid to an auditor, if any, and the auditors’ terms of engagement.

6

Prepare a report to be included in the financial statements

- Describing how the audit committee carried out its function.

- Stating whether the auditor was independent of the company.

- Comments on the financial statements, the accounting practices, and the internal financial controls.

5

Receive and deal appropriately with all complaints

8

Make submissions to the Board on any matter concerning the accounting policies, financial controls, records, and reporting.

9

Review the quality and effectiveness of the external audit process.

2. People

The Committee comprised of at least three independent members that were elected by the Board of Directors and could be terminated at any point in time. It also had three co-opted participants who are qualified chartered accountants to strengthen the financial skill component of the ARC.

The following people were invited to attend committee meetings: CEO, CFO, Head of Operations, legal advisor, external auditors, internal auditors and the Company Secretary.

Brief description of roles and responsibilities

The War Room was established as the strategising and executing engine of the Fund that supported rapid and informed decision making. The war room met daily to enable quick decision making. As the intensity of strategic decisions on programmes reduced, the frequency of these meetings also reduced (after 18 to 24 months).

The respective pillar heads or other executives would bring key proposals to the War Room with a business case to seek approval on budgetary or resource requirements.

1. Responsibilities

The War Room was responsible for making key recommendations to inform decision making, and to ensure that all decisions enabled the delivery of the Fund’s mandate and were closely aligned to the Fund’s values.

2. People

Attendees included the entire Exco, the Chairman, the Deputy Chairman and the Fund’s Advisor. This meeting was chaired by the CEO.

One of the key success factors for the Fund was a strong partnership with government and business, while also remaining independent. The independence of the Board was important to ensure that the Fund had an independent identity, freeing it from any negativities that might be associated with other entities and allowing it access to the widest spectrum of society.

Following agreement at NEDLAC, the announcement of the Solidarity Fund by the presidency helped to gain support from the nation as a whole – business, government, and civil society.

The principle of operating at speed was only possible through an empowered Executive and CEO that could make informed and effective decisions with a supportive governance structure that was able to turn decisions around rapidly.

The was sometimes tension between speed, action and governance. The Fund was established within one month of the concept being mooted, and governance processes were established as the Fund began implementing. Governance was key to maintaining accountability and trust. Setting up a governance framework that supported rapid turnaround was critical to the Fund’s success.

It is important to define the reporting requirements for implementation partners upfront and to have an efficient contracting process.

Defining and assessing risks, and mitigation of those risks, in project proposals is critical to ensuring successful implementation of projects.